“Our constitution gives Pennsylvanians the right to clean air, to pure water, and to the preservation of the natural, scenic, historic and esthetic values of the environment. We have a constitutional obligation to leave Penn’s Woods better than we found them—and today we act decisively to fulfill it.” –Governor Tom Ridge at the signing of the original Growing Greener legislation on December 15, 1999

The Beginning (1999)

The program known as Growing Greener began in 1999 when Governor Tom Ridge and legislative leaders enacted Act 68 of 1999 with overwhelming bipartisan support—the bill passed nearly unanimously in the Senate (a 49–1 vote) and unanimously in the House of Representatives. The bill created the Environmental Stewardship Fund (ESF) and committed $650 million over five years for investments in preserving farmland, conserving open space, restoring water quality, promoting outdoor recreation, and revitalizing communities.

A Dedicated Funding Source (2002)

In 2002, Governor Schweiker and the General Assembly passed legislation creating a dedicated source of revenue for the ESF by authorizing an increase in the tipping fee (the fee for dumping trash in landfills). This dedicated source generates approximately $60–65 million annually and is allocated to four state agencies for environmental restoration, land conservation, and community recreation and revitalization projects.

Growing Greener II (2005)

Governor Ed Rendell and the General Assembly, recognizing the need to accelerate the work being accomplished by Environmental Stewardship Fund investments, decided to put a $625 million bond referendum question to the voters. In the 2005 primary election, 60% of voters approved the bond, and the program known as Growing Greener II was established with the signing of Act 45. The $625 million was spread out over six years among six state agencies (see Allocation). All Growing Greener II funds have been spent or obligated.

Following the voters’ approval of the Growing Greener II bonds in 2005, the General Assembly and governor enacted legislation that contained a provision providing an option for Growing Greener II debt service to be paid out of the ESF, contrary to the normal practice of paying debt service out of general funds. In subsequent years, Governor Rendell and the General Assembly did in fact tap the ESF to pay debt service, diverting tens of millions of dollars each year from environmental conservation and restoration work that the Fund would have otherwise supported. This practice has continued under each subsequent governor.

Act 13 (2012)

In 2012, Governor Corbett and the General Assembly enacted Act 13, which created the Marcellus Shale Legacy Fund (MSLF). Act 13 established two separate streams of money to flow from the MSLF to the ESF:

- A portion of the annual revenue from impact fees charged for oil and gas drilling.*

- Annual transfers from the Oil and Gas Lease Fund (OGLF), which pass from the OGLF to the MSLF to the ESF. Act 13 called for an initial annual transfer of $20 million and $35 million thereafter.

*Act 13 established the Unconventional Gas Well Fund to which gas drilling fees under the act were directed. Act 13 appropriated the money in the Unconventional Gas Well Fund for various entities and purposes. Act 13 provided that after all these appropriations were made, 40% of remaining funds were deposited into the MSLF, with 10% of those funds appropriated to the ESF. This percentage was projected at the time to equal $30–35 million per year.

Recent Years

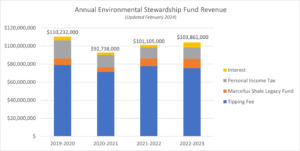

From 2012–2015, transfers from the OGLF to the ESF varied between $20 million and $35 million. But in the 2015–16 budget, the legislature limited the amount of OGLF transfer money to $20 million, where it has stayed in subsequent years. Combined with impact fee revenue (generally $6–$8 million), tipping fee revenue (generally $60–$65 million), and interest, the ESF has received $90–110 million per year in recent years. See the following MSLF annual reports and the charts below for more information about ESF revenue.

Since 2020, lawmakers have made appropriations from Personal Income Tax (PIT) revenues to offset the debt service payments for Growing Greener from the ESF. Matching dollar-for-dollar, these appropriations have provided a much-needed relief to the debt service and unlocked millions in revenue that is used across the commonwealth for environmental projects. PIT transfers are projected to decrease over time as revenues pay off the principal of the debt service obligation, resulting in a reduction of interest payments. Transfers from 2020 to 2024 have already been reduced by $3.2 million, where payments decreased from $13.7 million in 2020 to $10.5 million in 2023. PIT receipts to the ESF can be found in the Commonwealth Budget.

See Allocation for more details about how ESF funds are allocated to state agencies.